Fill Out the Form

Provide your details to see available investment options.

INVESTMENT

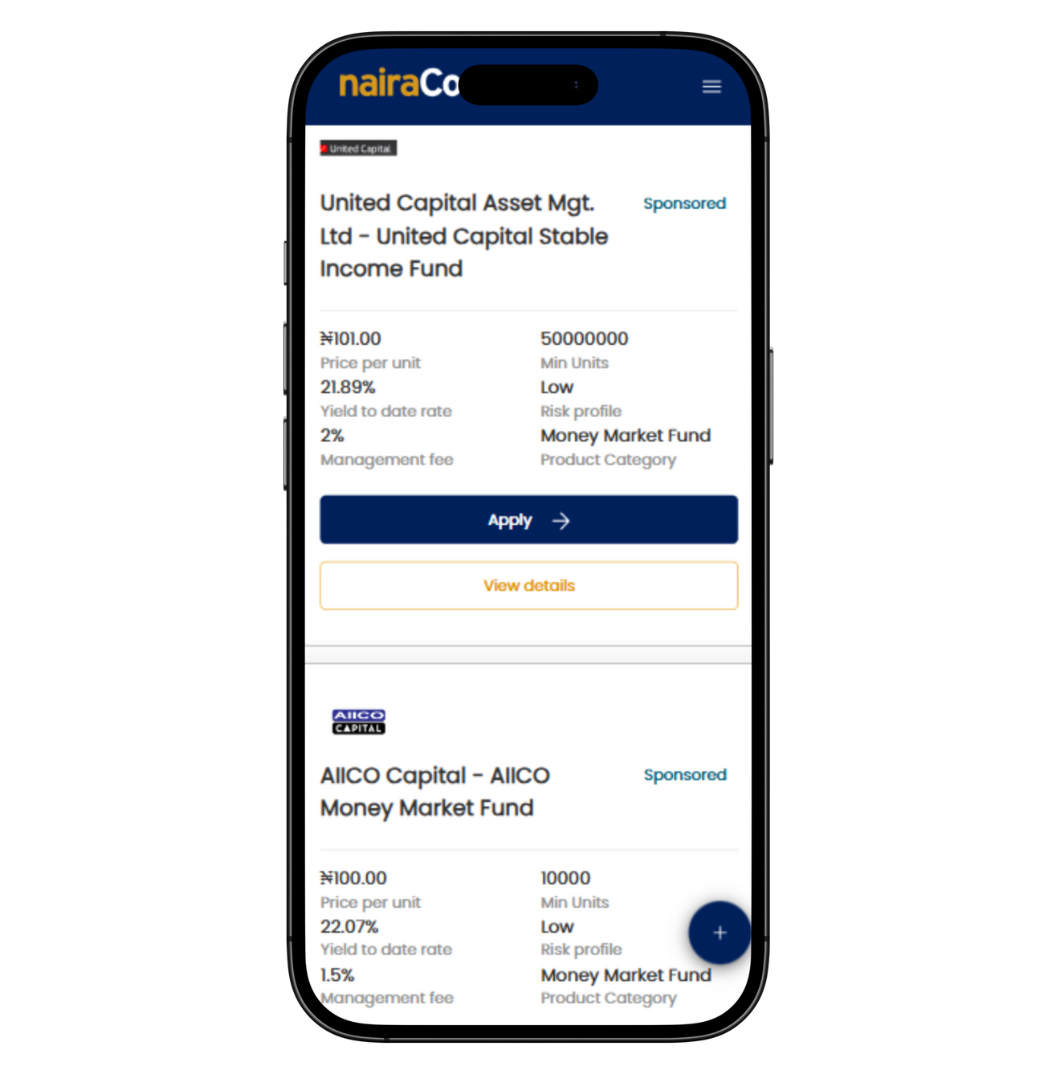

Earn up to 23% yearly. Returns vary by product and market trends.

Choose from tenures ranging from 3 months to 5 years.

Funds are managed by licensed and regulated providers

Step 1

Provide your details to see available investment options.

Step 2

Review interest rates and terms from licensed investment providers.

Step 3

Select a suitable plan and proceed to invest directly with your chosen provider.

nairaCompare is a comparison platform, not a direct financial service provider. All financial products listed are offered by licensed third-party institutions. Terms and rates are subject to change by providers.

Short-term investments and long-term investments differ primarily in their investment duration and objectives. Short-term investments are typically held for a brief period, usually one year or less, and aim to preserve capital while providing liquidity.

On the other hand, long-term investments are held for an extended period, often several years or decades, with the goal of achieving capital appreciation and growing wealth over time.

Choosing the right investment depends on your goals, risk tolerance, and timing. Research different investment options on nairaCompare, also consider seeking advice from financial professionals, and align your choices with what you're comfortable with and what you're aiming to achieve.

Saving involves setting aside money in a secure account, like a savings account or fixed deposit, with the intention of preserving your funds and having quick access to them. While savings are important for short-term goals and emergencies, they typically yield lower returns over time.

On the other hand, investing involves putting your money into assets such as stocks, bonds, or real estate, with the aim of potentially earning higher returns over an extended period. Investing carries more risk than saving but offers the potential for greater wealth accumulation and achieving long-term financial goals, such as retirement or funding major life milestones.

Diversification involves spreading your investments across different asset classes to reduce risk. It helps minimize the impact of poor performance in one investment on your overall portfolio and can enhance long-term stability. Building a diversified investment portfolio involves strategically spreading your investments across a variety of assets to reduce risk and optimize potential returns. Diversifying your investments and having a long-term perspective can help cushion the impact of losses and potentially recover over time.

Stocks represent ownership in a company, offering high returns but also higher risks. Bonds, on the other hand, are debt instruments where investors lend money to issuers (like governments or corporations) and receive fixed interest payments over time with lower risk compared to stocks.

Trust & Security!

Information on data security, privacy policies, and customer support

By continuing, you agree to our Terms & Conditions and Privacy Policy.