Hidden Factors That Could Be Hurting Your Credit Score in Nigeria Without You Knowing

Author Eyitemi Efole

A good credit score in Nigeria is essential for securing loans, mortgages, and even business financing. However, many Nigerians assume that only missed payments hurt their scores. In reality, several hidden factors could be silently damaging your creditworthiness.

Understanding these overlooked influences can help you avoid financial pitfalls and improve your credit score. This article explores how low credit utilization, inactivity, multiple credit applications, and other factors can unexpectedly impact your score—and what you can do to protect it.

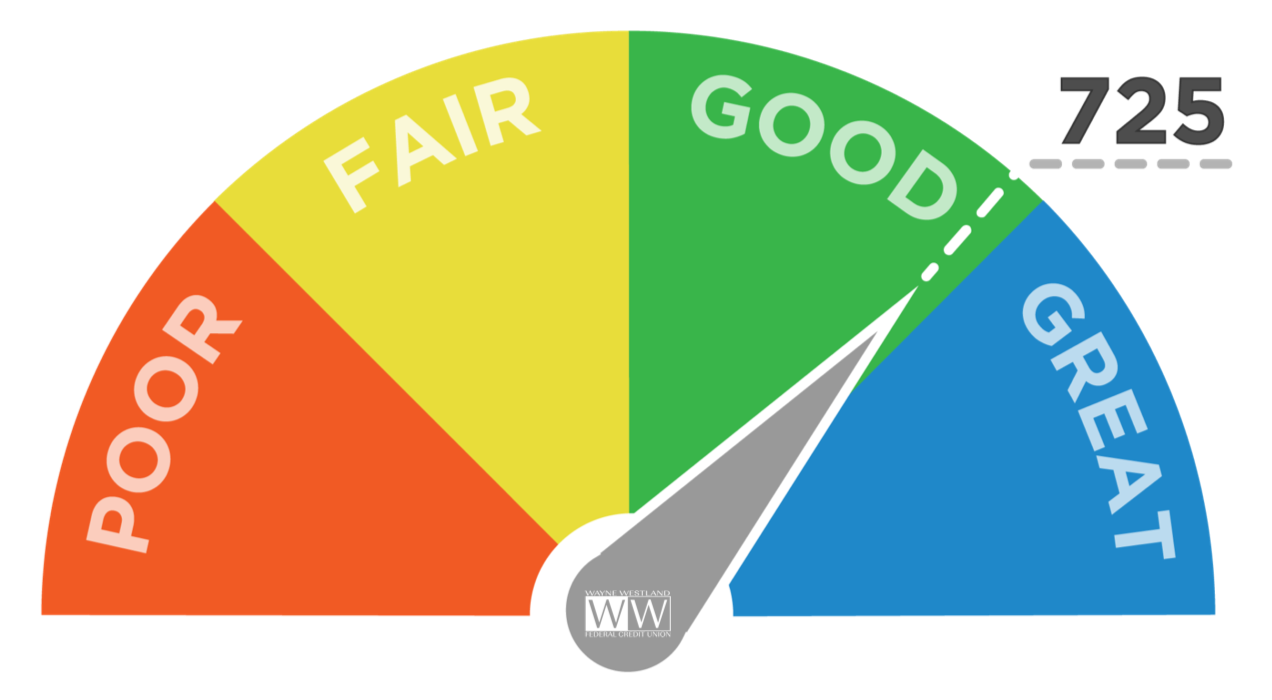

📌 Did you know? Credit scores in Nigeria range from 300 to 850, with 500+ being considered good by most financial institutions.

1. Low Credit Utilization Ratio: A Double-Edged Sword

Your credit utilization ratio measures how much of your available credit you are using. It’s calculated as:

Credit Utilization Ratio = (Total Credit Used ÷ Total Credit Limit) × 100%

Ideal Range & Risks

-

Ideal Range: 10% - 30%

-

Too High (above 50%) → Indicates overreliance on credit, which lowers your score.

-

Too Low (below 10%) → May signal underutilization, making lenders hesitant to extend more credit.

Tips for a Healthy Ratio

- Keep utilization between 10% - 30%

- Spread spending across multiple credit lines

- Pay off balances in full before due dates

📌 Pro Tip: Check your credit score on nairaCompare.ng.

2. Inactivity Can Be Harmful: The Dormant Account Dilemma

Unused credit accounts might seem harmless, but inactivity can lower your credit score. Lenders prefer active credit users who consistently show responsible credit management.

Hidden Risks of Inactivity

- Account Closure: Banks may close inactive accounts, reducing your available credit limit and increasing your credit utilization ratio.

- Shorter Credit History: Old accounts boost your credit age, which strengthens your score. Closing them can hurt your history.

How to Keep Accounts Active

- Make small, recurring purchases on old credit lines

- Set up automatic payments for subscriptions

- Avoid closing old accounts unless necessary

📌 Action Step: Review your dormant accounts and reactivate them wisely!

3. Guarantor Gone Wrong: The Risk of Being a Guarantor

Becoming a loan guarantor in Nigeria is a huge financial risk. Many don’t realize that if the borrower defaults, the guarantor’s credit score is also affected.

Risks of Being a Guarantor

- Debt Liability: If the borrower fails to repay, you are legally responsible.

- Credit Damage: Late payments or defaults appear on your credit report.

- Loan Restrictions: You may struggle to secure personal loans while guaranteeing another person’s loan.

How to Be a Responsible Guarantor

- Only guarantee loans for trustworthy individuals

- Review loan terms carefully before signing

- Monitor the borrower's repayment behaviour

📌 Before agreeing to be a guarantor, use nairaCompare.ng to compare lender terms.

4. Multiple Credit Applications in a Short Time: The Search for Credit

Applying for multiple loans or credit cards within a short period can drastically reduce your credit score due to “hard inquiries.”

Understanding Hard Inquiries

A hard inquiry occurs when a lender checks your credit report to evaluate loan eligibility. Too many inquiries signal financial distress and reduce your score.

Tips to Avoid Over-Application

- Space out applications: Wait 3-6 months between credit applications.

- Compare loan options before applying: Use nairaCompare.ng to check loan eligibility without affecting your score.

- Opt for pre-approval checks: Some lenders offer soft checks that don’t impact your credit score.

5. Errors on Credit Reports: The Need for Regular Checks

Credit report errors are more common than you think! A simple mistake—like an incorrect balance or fraudulent account—could be damaging your credit score without you knowing.

Common Credit Report Errors

- Incorrect personal details (wrong name, phone number, or BVN)

- Unrecorded loan payments (you paid, but the bank didn't update your report)

- Fraudulent activity (unknown loans opened in your name)

How to Check & Fix Errors

- Request for your credit report

- Report inaccuracies immediately to the bureau and your lender

- Follow up to ensure corrections reflect on your credit score

📌 Get a one-time free credit score check via nairaCompare.ng.

6. Ignoring Judgments and Legal Issues

Court judgments, unpaid debts, and legal disputes can severely damage your credit score in Nigeria.

How Legal Issues Affect Credit

- Unpaid debts can turn into court cases, leading to negative reports on your credit file.

- Garnished wages or frozen accounts affect financial stability.

- Legal judgments stay on your credit report for years, reducing loan eligibility.

How to Avoid Legal Credit Issues

- Negotiate debt repayment plans early

- Respond to court summons promptly

- Seek legal advice if sued over a debt

7. Joint Accounts and Shared Financial Responsibility

A joint account can be convenient for couples, business partners, or family members—but it also links your credit score to another person’s financial habits.

Dangers of Joint Accounts

- If your partner misses a payment, it reflects on your credit report.

- Mismanaged debts on the account lower your eligibility for future loans.

- Separation or disputes can complicate credit score recovery.

How to Manage Joint Credit Wisely

- Only open joint accounts with financially responsible partners

- Set clear spending limits and repayment schedules

- Monitor account activity regularly

Conclusion

Taking Control of Your Credit Score

Your credit score in Nigeria is more than just payment history—it’s influenced by factors like credit utilization, inactivity, multiple applications, guarantor risks, legal issues, and joint accounts.

How to Improve & Maintain a Good Credit Score

- Use credit responsibly and maintain a healthy utilization ratio

- Avoid multiple credit applications in a short period

- Check your credit report regularly for errors

- Be cautious before becoming a guarantor

- Resolve legal and debt issues proactively

By understanding these hidden credit score killers, you can protect your financial future and secure better loan opportunities.

📌 Take charge today! Compare loan and savings options on nairaCompare.ng to improve your financial health.

About Author

Eyitemi Efole

Eyitemi Efole is exploring the marketing field, with a particular interest in brand management, strategy, and operations. She is keen on understanding how brands build trust and connect meaningfully with their audience.

.png?width=1615&height=444&name=nairaCompare%20Christmas%20logo%20(PNG).png)