Advantages of Fixed Deposits: Real Life Examples of Higher Returns

Author Taiwo Temitope-Adesope

Ademola Oke, a 45-year-old marketing manager based in Lagos, Nigeria, tries to put a portion of his salary — even if it’s only ₦10,000 — into a fixed deposit account every month. Oke, who earns between ₦3,000,000 to ₦4,000,000 annually, hasn’t started saving for retirement and wants to save more.

But every month, it feels impossible after paying for his basic expenses.

“The money’s just not there at the end of the month,” he says. “By the time I’m done paying for my basic bills, basic groceries, and stuff like that, I’m lucky if I have up to ₦5,000 to ₦10,000 to save. I’m terrified of having no money saved up for retirement.”

Oke is one of millions of employed Nigerians who are struggling to save money right now. Over half of Nigerian workers say it’s either difficult or impossible to consistently save enough money to feel comfortable for emergencies, retirement, or any other reason, given their current financial situation, according to recent surveys.

%20(80).png?width=600&height=200&name=Copy%20of%20Introducing%20the%20Money%20in%20Minutes%20Business%20Loan%20(Email%20Header)%20(80).png)

However, there is a more effective approach for Nigerians to secure their financial future: investing in a fixed deposit. With a fixed deposit, you don’t have to keep adding money regularly. Instead, you can deposit a lump sum and let the interest grow your savings over time.

Consider this: If you receive a lump sum from your leave allowance, furniture grant, or cash gifts from family members, you can invest that amount in a fixed deposit account with a high interest rate. This way, your money works for you without the need for continuous contributions.

See for yourself: We've crunched the numbers and compiled charts that show why a fixed deposit is more advisable in Nigeria, and how putting away a small amount in a fixed deposit can add up to a substantial amount of money over time.

Charts that show the power of fixed deposits

For this example, we're using the FirmEdge Account by Firmus Microfinance Bank, which has an interest rate of 18 - 21%, and the Firmus Save Account which has a 10% interest rate.

Let's assume Mr Oke saved 50, 000 every month in the Firmus Save Account and compare it to if he saved 2,000,000, in the Firmus FirmEdge account for 1, 5, 10, and 15 years.

For more clarity, look at this table

| Years | Firmus Save Account | Firmus FirmEdge Account |

| 1 Year | ₦633,514.06 | ₦2,420,000.00 |

| 5 Years | ₦3,904,119.06 | ₦5,187,484.92 |

| 10 Years | ₦10,327,601.02 | ₦13,454,999.90 |

| 15 Years | ₦20,896,213.29 | ₦34,898,804.54 |

From the comparison above, it's clear that fixed deposits outperform traditional savings accounts over time. We can see that even with a monthly deposit of ₦50,000 in a savings account versus a one-time ₦2,000,000 deposit in a fixed deposit account, the growth potential of fixed deposits is significantly higher across various timeframes.

Let's look at a second example:

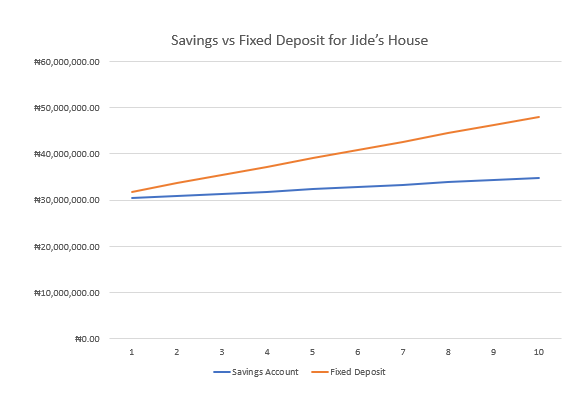

Jide is aiming to buy a house that costs ₦50,000,000. He has ₦30,000,000 and is aiming to save up to ₦50,000,000. in the next 10 years. Here are two possible outcomes depending on if he decides to save his money in a fixed deposit account or if he decides to save in a regular savings account.

Savings Account (10 years, 1.5% interest): Even with compounding over 10 years, Jide's money would grow to approximately ₦39,041,190.60.

Fixed Deposit (10 years, 6% interest): Locking in a fixed rate of 6% for 10 years guarantees predictable growth. After 10 years, Jide's total amount would be around ₦57,434,992.13 (₦30,000,000 principal amount + compounded interest over 10 years).

Take a look at this breakdown to see how the money will grow over the 10 years in the respective accounts:

| Year | Savings | Fixed Deposit |

| 1 | ₦30,450,000.00 | ₦31,800,000.00 |

| 2 | ₦30,906,750.00 | ₦33,600,000.00 |

| 3 | ₦31,370,351.25 | ₦35,400,000.00 |

| 4 | ₦31,840,906.52 | ₦37,200,000.00 |

| 5 | ₦32,318,520.12 | ₦39,000,000.00 |

| 6 | ₦32,803,297.92 | ₦40,800,000.00 |

| 7 | ₦33,295,347.39 | ₦42,600,000.00 |

| 8 | ₦33,794,777.60 | ₦44,400,000.00 |

| 9 | ₦34,301,699.26 | ₦46,200,000.00 |

| 10 | ₦34,816,224.75 | ₦48,000,000.00 |

- Total earned in savings account: ₦9,041,190.60

- Total earned in fixed deposit: ₦27,434,992.13

Fixed Deposit Advantage over 10 Years:

- Substantially higher earnings: Jide earns almost three times more with the fixed deposit due to the higher interest rate.

- Predictable growth: The fixed interest rate ensures Jide knows exactly how much his money will grow over 10 years, aiding in financial planning for the house purchase.

Here is a graph to show you the difference between if Jide saves in a savings account vs if he saves in a savings account.

For a large down payment with a long saving timeframe, a fixed deposit offers a clear advantage due to the guaranteed higher return.

These examples highlight the power of compounding interest and the advantage of locking in your funds at a favourable rate. For Nigerians looking to secure their financial future without continuous contributions, a fixed deposit is a great opportunity to grow wealth steadily.

%20(81).png?width=600&height=200&name=Copy%20of%20Introducing%20the%20Money%20in%20Minutes%20Business%20Loan%20(Email%20Header)%20(81).png)

Ready to secure your financial future? Finding the right fixed deposit account is crucial. Compare fixed deposit options on nairaCompare today and open an account that suits your needs.

Explore our comprehensive list of financial institutions offering competitive interest rates, ensuring your savings grow faster. Take charge of your financial goals now.

Visit nairaCompare, compare fixed deposit rates, and open your account today to start building your wealth!

On nairaCompare, we have various providers you can compare from including Polaris, Alert MFB, ARM Investments, Letshego Etc. Visit our website and start your journey towards growing your money!

Conclusion

For many Nigerians, saving for the future feels out of reach. But as we've seen, fixed deposits offer a powerful tool to overcome this challenge. Even with a one-time deposit, you can leverage compound interest to grow your wealth significantly over time.

This approach is particularly beneficial for those who may find it difficult to contribute regularly. Fixed deposits allow you to "set it and forget it," letting your money work for you without the need for continuous saving efforts. Don't wait! Open a fixed deposit account now!

About Author

Taiwo Temitope-Adesope

Taiwo is a passionate storyteller and strategist dedicated to empowering women and crafting compelling narratives. A First-Class graduate in Mass Communication from Covenant University, she specializes in writing, public relations, and digital marketing. As a Content Manager at Suretree, she drove a 50% increase in web traffic through SEO and boosted website engagement by 60% in just four months. Her leadership experience includes serving as Public Relations Officer for the Covenant University Student Council and contributing to impactful volunteer initiatives. With expertise in strategic thinking and business acumen, Taiwo continues to create stories that inspire confidence and imagination.

%20(55).png?width=600&height=200&name=Copy%20of%20Introducing%20the%20Money%20in%20Minutes%20Business%20Loan%20(Email%20Header)%20(55).png)

.jpg?width=352&name=How%20to%20Stay%20Liquid%20While%20Investing%20in%20Fixed%20Deposits%202%20(1).jpg)